San Francisco, December 20, 2022: With the world observing unprecedented challenges and the influence of climate change, the water and wastewater treatment industry size could be pronounced on the back of bullish investment in a sustainable future. Developments of environmental, social, and governance practices will help stockholders map impacts to their value chain, enable performance reporting and tracking and exhibit a corporate commitment to sustainable growth. Industry leaders are expected to shift their attention to the impact of water shortages, soaring prices, and surging regulations in their decision-making. Stakeholders are emphasizing 4R—reduce, reuse, recycle and reclaim—to streamline wastewater treatment and propel ESG compliance. Investors and consumers are poised to focus on the ESG profile and minimize operational risks amidst concerns about pollution, energy consumption, climate change, and the rising usage of chemicals.

|

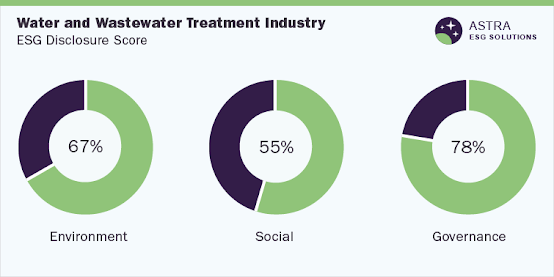

| Water and Wastewater Treatment Industry ESG |

The World Resources Institute forecasts a 56% deficit of freshwater by 2030, compelling businesses to propel the management of water and wastewater treatment. The prevalence of water pollution and its impact on global health has furthered the need for setting and achieving ESG goals. Sustainable wastewater management has gained ground amidst an uptake in wastewater generation. For instance, in 2021, Merck Group produced around 13.3 million cubic meters of wastewater, while discharging approximately 9.5 million cubic meters of freshwater in surface waters. The company aims to minimize possibly harmful residues in wastewater by 2030. The surge in municipal wastewater and the prevalence of sewage have prompted stakeholders to emphasize environmental, social, and governance pillars to keep up with the global trend.

Environmental Perspective

Investors, suppliers, and other stakeholders have prioritized the upsides of water treatment projects to minimize power consumption, reduce water use from the local supply, free up space and reduce off-spec discharge risk. Although the majority of Americans have access to safe drinking water, harmful contaminants, including copper, lead, and arsenic, have been found in tap water. Leading companies are expected to further their efforts to contain negative environmental impacts from chemical spills, wastewater discharges, or water quality violations. For instance, California Water Service Group asserts its customers saved 47.8 million gallons of water in 2021 with increased saving efficiency measures. The public utility company assesses treatments on an industry-wide level, conducts audits, and undertakes regular maintenance of wastewater treatment systems.

ESG considerations have become a management priority with wastewater reduction slated to foster the company’s environmental profile. Xylem, Inc. has set a bullish goal to recycle 100% of its wastewater by 2025. In May 2022, it introduced a smart wastewater treatment solution that can reduce operating costs and energy use by 25%. In April, the company announced an infusion of USD 20 million to foster innovative water and industrial technologies. Besides, Ecolab claims it helps customers manage 1 trillion gallons of water through the use of real-time data, management software tools, innovative technologies, and treatment services. It also aims to conserve around 300 billion gallons of water annually by 2030. The company has also designed a wastewater treatment station in France to minimize water discharge to the city sewer network by approximately 80%, enabling the facility to reuse around 20 million gallons of water each year.

Social Perspective

Stakeholders have furthered their efforts on workforce development, diversity, equity, safety, and health. Sustainable investors are likely to respond to the expanding scope of the social pillar as businesses and technological advances become interconnected. ESG-focused company Xylem remained at the helm with a roughly 80% score. The growth trajectory is partly attributed to robust human rights policies. Meanwhile, Ecolab has furthered its commitment to propel diversity and equity through its 2030 Impact Goals. The company contemplates augmenting its management-level gender diversity to 35% and management-level ethnic diversity to 25%. It has emphasized educating interview teams, recruiters, and hiring managers on bias, diversity, and inclusion. For instance, while 35% of all new management-level hires in the U.S. were people of color in 2021, globally around 38% of all new management-level hires were women.

Industry participants are striving to retain and attract talent—Veolia invested in an ambitious policy as the average number of hours of training per employee touched 21 in 2021. It aims to minimize the frequency of workplace accidents from 6.65 in 2021 to 5 by 2023. Besides, Ecolab hired 8,905 new employees in 2021, while the average turnover rate was pegged at 17.4%. Meanwhile, Xylem provided 12.61 hours of training per employee in 2021 and has introduced employee training programs, such as Employee Network Groups, Ignite, and Watermark. It has strengthened workplace safety by introducing safety alerts and expanding digitally connected safety programs. According to Xylem Sustainability Report 2021, 49 of its facilities witnessed zero accidents in 2021, along with Querétaro, Mexico, São Paulo, Brazil, and Bogotá, Colombia facilities achieving five years without any recordable cases.

Governance Perspective

Leading players have pushed the bar with growing traction for strong corporate governance that bolsters accountability, underpins the long-term interest of shareholders, and propels brand position. To illustrate, Xylem's Board of Directors (end of 2021) comprised ten members, and all except CEO were independent. The soaring significance of ESG encouraged the organization to form the ESG Reporting Working Group to advise on, review and guide the evolution of its approach to ESG disclosure. It has also adopted 2025 Sustainability Goals to provide 35% of women with leadership roles by 2025.

Robust corporate governance is paramount to growing and sustaining businesses as companies seek to comply with core values and commitment to ethical standards and board diversity. For instance, 5 out of 12 California Water Service Group directors are women and the organization has 10 out of 12 independent director nominees. The utility company showed traction for a host of public policy initiatives in 2021, including the provision of up to USD 55 billion to address water infrastructure challenges.

According to Astra’s scoring model, Dupont de Nemours, Inc. was placed at the top in terms of corporate governance. The trajectory is mainly attributed to the governance standards and credibility among stakeholders—more than 90% of the board comprises independent directors. Furthermore, it has set the Sustainability Oversight Committee to review and approve sustainability policies and initiatives and oversee the Strategic Leadership Council’s work. In doing so, the company has embedded ethics and sustainability across global supply chains to propel a circular economy, climate change, and diversity.

Well-established players and new entrants are expected to propel innovations and sustainability portfolios in treatment, water reuse, and -loss. Stakeholders are touted to expedite technological advancements, mergers & acquisitions, and commercial and social innovations. To illustrate, in August 2022, Veolia announced it inked a merger agreement with Vigie SA (previously known as Suez SA). While the actual merger took place in January 2022, the final merger was scheduled for October 2022.

With industry leaders emphasizing the reuse and recycling of wastewater, prevailing dynamics are likely to reshape the ESG landscape. An emphasis on cost reduction in wastewater treatment plants could help customers keep up with their operational budget. For instance, digitization is likely to help companies cash in on water, cost, and energy efficiencies. Advanced solutions can provide real-time data to offer recommendations and suggestions to optimize aeration and water usage. Accordingly, the water and wastewater treatment market size could garner USD 41.8 billion by 2030. Bullish demand for wastewater treatment technologies and rigorous regulations will provide tailwinds to the global landscape.

Browse more ESG Thematic Reports from the Utilities Sector, published by Astra - ESG Solutions

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. - a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

Need expert consultation around identifying, analyzing and creating a plan to mitigate ESG risks related to your business? Let Astra know your concerns and queries, and we can help!