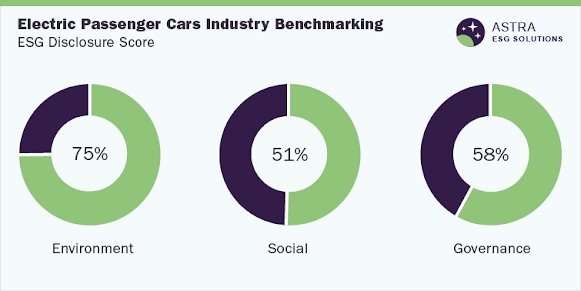

Sustainability for mobility has prompted electric passenger cars industry players to prioritize environmental, social and governance (ESG) goals. Heightened demand for decarbonization and the need to bring sustainability perspectives into management have encouraged incumbent companies to foster their ESG strategies. Climate change response has become global, suggesting an emphasis on the environment throughout the value chain, including design, manufacturing, procurement, logistics and disposal.

Premium automotive brands have shifted their attention toward sustainability to improve customer trust, boost compliance, enhance investor confidence and bolster brand reputation. A transition towards electric brands comes against the backdrop of soaring inflation, supply chain disruption and higher interest rates. In an unexpected turn of events, the exorbitant price of lithium propelled production costs for EVs; Russia’s Ukraine invasion and surging energy prices have had an overarching influence on the global economy.

AB Volvo Redefines Scope 3 Emissions for Consumer-Driven Culture

Although 2022 was a year full of challenges for automakers, 2023 has promised to provide compelling opportunities to navigate ESG strategies. Predominantly, AB Volvo has taken a giant stride to combat climate change—contemplating minimizing scope 1 & scope 2 emissions by 50% by 2030. The Swedish multinational company aims to cut scope 3 emissions by 40% per vehicle Km from trucks and buses, respectively, and 30% from construction equipment by 2030. The automotive giant has upped its efforts to do away with conventional energy sources and adopt renewable sources. During 2022, there was a 32% reduction in tailpipe emissions per average vehicle (vis-à-vis 2018 baseline). The company is gearing up to develop renewable electricity for vehicle charging, alluding strong demand for bio-based materials.

Is your business one of participants to the Electric Passenger Cars Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices

Toyota Prioritizes Social Sustainability

Workplace safety, reduction in accidents and diversity are shaping the future of transportation as automakers inject funds into state-of-the-art products and services. With the demand for personal vehicles soaring, sustainable development has become invaluable to creating a prosperous society. To illustrate, Toyota Australia has powered 7,883 solar panels to its Altona Toyota Parts Centre, which produces 2.5MW. In FY 2022, the auto giant incentivized Toyota and Lexus customers to recycle 1,954 hybrid batteries to foster battery recycling. The automotive brand donated USD 3.4 million to community partners working in sustainability, education, traffic safety, social justice and the environment. Moreover, Toyota Kirloskar Motor, a Joint Venture between Toyota and Kirloskar, trained around 43,673 supplier members to boost environment and social performance.

Mercedes-Benz Ups Governance Stewardship

Decision-making bodies have exhibited concerted efforts toward transparency, ethics & compliance, robust corporate governance and board diversity to bolster their ESG performance. In 2021, Mercedes-Benz made a resource conservation policy to minimize the energy consumption per vehicle for cars by 43% and 25% for Vans by 2030. The Luxury vehicle company has introduced supply chain policies to allow purchasers to track material data with the help of blockchain technology. The automotive brand has propelled its diversity and equity portfolio to keep up with the Sustainable Development Goals, including gender equality and reduced inequalities. As of December 2021, Mercedes-Benz had 22.5% of women in senior management positions, while the Board of Management had 3 women and 5 men.

The competitive scenario indicates that forward-looking companies could focus on organic and inorganic strategies to expand their global footprint. In doing so, well-established players will likely invest in technological advancements, innovations, product offerings, collaborations, R&D activities and mergers & acquisitions. The electric passenger cars market size stood at USD 120.81 billion in 2020 and will witness a healthy CAGR of 32.5% between 2021 and 2028. The outlook suggests that the sustainability and success of automakers could depend upon sound corporate governance, bullish environmental targets and social sustainability.

About Astra – ESG Solutions by Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. - a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research