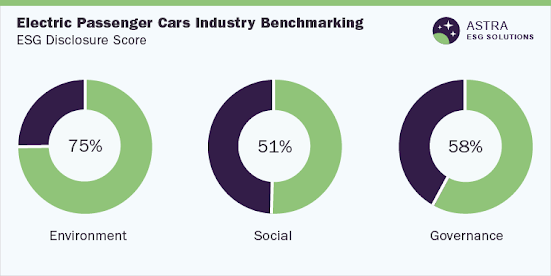

Sustainability Assessment, Policies & Regulations, ESG Issues, Infrastructure Developments, Company Profiles, Benchmarking, SWOT, Company ESG Disclosure Scores

The average ESG disclosure score for the lubricant market is between 55% and 65%. Our proprietary Environment, Social, and Corporate Governance (ESG) scoring framework analyzed 65 parameters across ESG, as represented in the methodology section of this document. Royal Dutch Shell, British Petroleum (BP), Chevron, and 11 more market leaders were part of our research. Three out of five companies we researched scored above the average industry score. However, four market leaders need to focus more on ESG reporting and transparency as they scored well below 50%.

For More Details: https://astra.grandviewresearch.com/lubricant-industry-esg-outlook

Environmental insights

Lubricant

comprises less than 10% additives and 90% base oil (like petroleum fractions,

called mineral oils). In rotating machinery, lubrication is crucial for

efficiency and durability. Lubrication reduces friction between machine parts

and enables them to move smoothly in a given direction. There is a negative

impact of lubricant on the environment, as it causes serious contamination of

soils and groundwater, as well as accumulates in plants and animal tissues.

There are various measures or technologies used by companies globally for the

sustainability of lubricants. One of the main alternatives to petroleum-based

lubricants is bio-based lubricants, which can help reduce environmental impact

and create green companies.

Social insights

Broadly,

social metrics represent an assessment of risks that a company might experience

from human capital and community, both. The parameters that are considered in

this category include not only the employee turnover rate but also health &

safety parameters, including injury rates, OHSAS certifications, employee

engagement programs, training, and community development, among others. Among

the companies within the sector, Idemitsu Kosan ranks highest on the social

pillar, with a score of around 70%. The company has institutionalized robust

human rights monitoring mechanisms not only within its own operations but also

across the operations of its entire supply chain.

Governance insights

The

governance aspect within the purview of ESG assessment is one of the most

important foundation stones of a company, which includes various metrics,

including business ethics, board structure, financial transparency,

anti-corruption, and insider trading, among others. As per Grand View

Research’s ESG scoring model, Chevron ranks the highest in corporate governance

among its peers operating within the lubricants sector. The company has the

highest number of independent directors (over 90% of the board comprises

independent directors), which enhances corporate credibility and governance

standards in the eyes of investors and consumers. Chevron has also

institutionalized one of the best-in-class ethics platforms that manage any

form of misconduct within the company.

Request for Free Demo: https://astra.grandviewresearch.com/lubricant-industry-esg-outlook/request/rs1

%20Terminal%20Industry%20ESG.png)